IRS Instruction 1098-C 2019-2026 free printable template

Show details

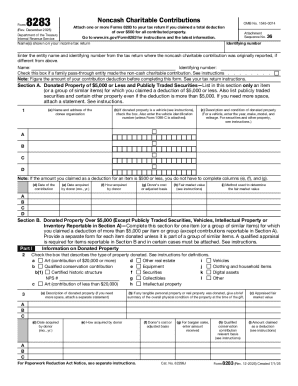

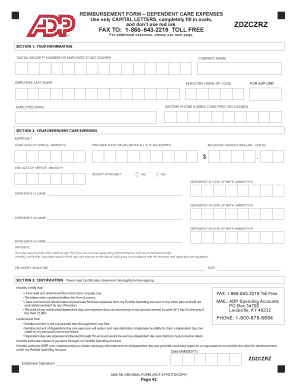

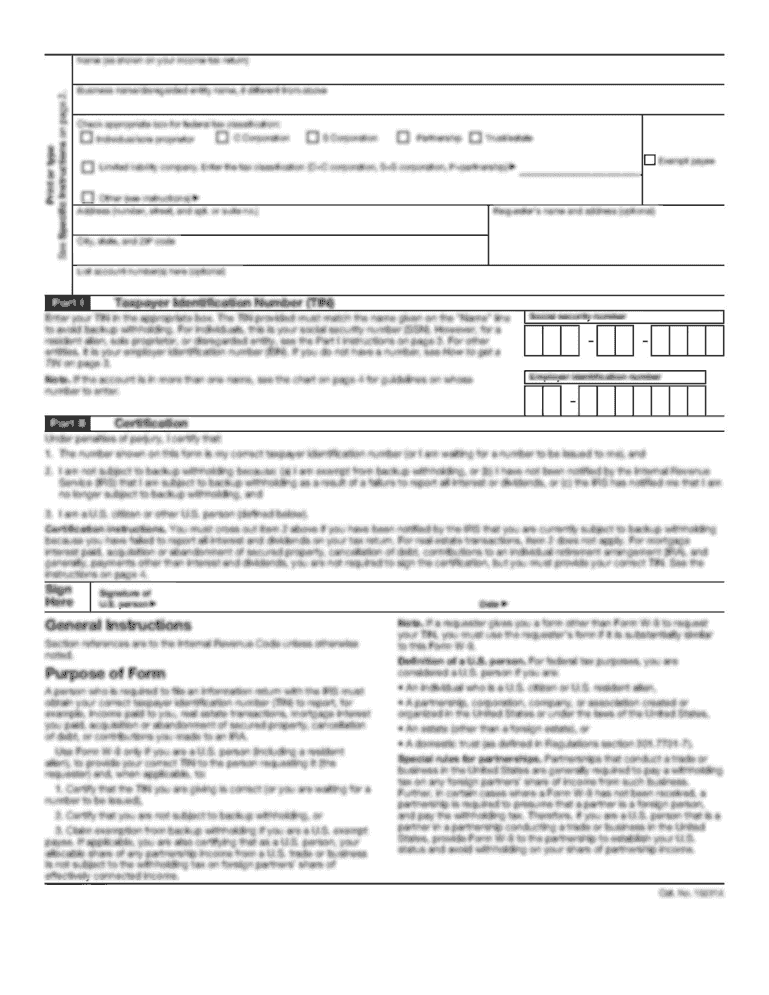

Section 6720 Penalties For the latest information about developments related to Form 1098-C and its instructions such as legislation enacted after they were published go to IRS.gov/Form1098C. 37. Specific Instructions Who Must File A donee organization must file a separate Form 1098-C Contributions of Motor Vehicles Boats and Airplanes with the IRS for each contribution of a qualified vehicle that has a claimed value of more than 500. Truncating donor s TIN on acknowledgements. Pursuant to...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign form 1098 c

Edit your 1098 c form online

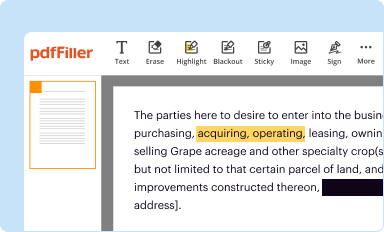

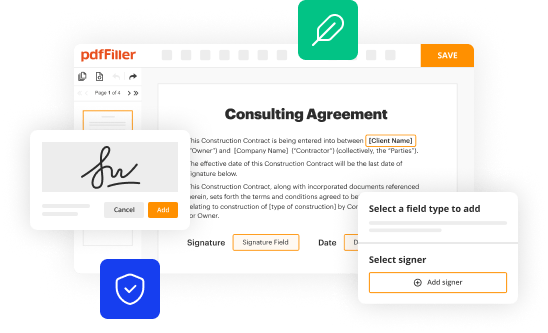

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1098 c form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs form 1098 c online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 1098 c instructions. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instruction 1098-C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out instructions 1098c form

How to fill out IRS Instruction 1098-C

01

Obtain IRS Form 1098-C from the donor or the organization receiving the donation.

02

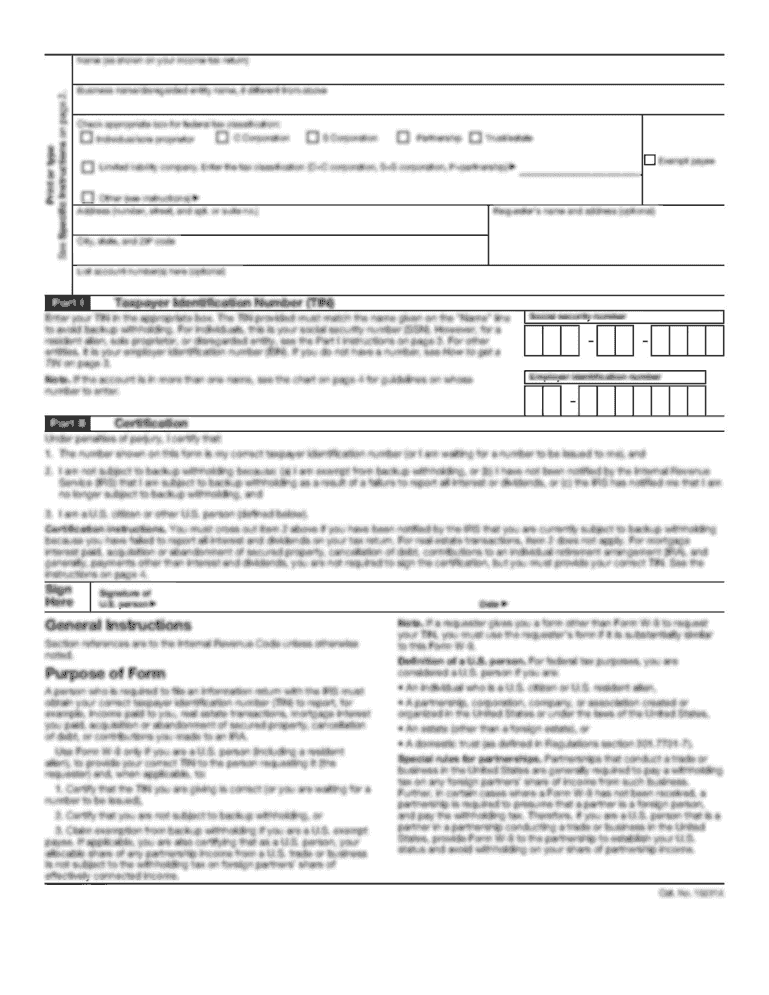

Enter the name, address, and taxpayer identification number (TIN) of the organization.

03

Provide the name, address, and TIN of the donor (individual or entity).

04

Fill in the date of the contribution.

05

Describe the vehicle or other property donated, including the make, model, and year.

06

Indicate the fair market value of the property at the time of donation.

07

Specify whether the donor received any goods or services in exchange for the donation.

08

Sign and date the form, if required, and provide a copy to the donor and the IRS.

Who needs IRS Instruction 1098-C?

01

Donors who contribute vehicles or other property to qualified charitable organizations.

02

Organizations that receive vehicle or property donations need to complete Form 1098-C for the donor.

Fill

form 1098c

: Try Risk Free

People Also Ask about 1098cform

Is a 1098 required?

File a separate Form 1098 for each mortgage. The $600 threshold applies separately to each mortgage, so you are not required to file Form 1098 for a mortgage on which you have received less than $600 in interest, even if an individual paid you over $600 in total on multiple mortgages.

How do I enter a 1098-C?

Sign in and open your return. In the upper right menu, search for 1098-C and select the Jump to link at the top of the search results. Answer Yes when asked if you made any donations to charity in 2021. Answer Yes when asked Do you want to enter your donations for 2021?

Will 1098 mortgage affect tax return?

The amount shown as interest paid on Form 1098 is the amount you use to determine how much to deduct on your tax return. Where do I take this deduction? Fill out Schedule A, Itemized Deductions, to take a deduction for mortgage interest.

Who is required to issue a 1098?

Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is $600 or more in interest, mortgage insurance premiums, or points during the tax year. Lenders must file a separate Form 1098 for each mortgage that they hold.

Who can issue a 1098?

Your mortgage lender sends your Form 1098 to you, generally by the end of January of the filing year.

What is a 1098 for tax purposes?

More In Forms and Instructions Use Form 1098 (Info Copy Only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from an individual, including a sole proprietor.

Are banks required to send 1098?

Lenders are required by the IRS to issue Form 1098s if the mortgage is secured by real property (defined as “land and generally anything built on it, growing on it, or attached to the land”). If real property does not secure the mortgage, then the lender does not have a requirement to send you Form 1098.

Is 1098 income or deductible?

The 1098 form and its variants are used to report certain contributions and other possible tax-deductible expenses to the IRS and taxpayers. In particular, they cover mortgage interest payments; contributions of motor vehicles, boats, or airplanes; student loan interest paid; and tuition and scholarship information.

Where does 1098-C go on tax return?

If you e-file your tax return, you'll need to mail a copy of Form 1098-C to the IRS along with Form 8453 after you e-file, or include Form 1098-C as a PDF attachment if your tax software allows. The 1098-C shows the gross proceeds from the sale of the vehicle unless one of the following two exceptions applies.

What does a 1098 do for taxes?

Use Form 1098 (Info Copy Only) to report mortgage interest of $600 or more received by you during the year in the course of your trade or business from an individual, including a sole proprietor.

How do I report a 1098-C form?

If you e-file your tax return, you'll need to mail a copy of Form 1098-C to the IRS along with Form 8453 after you e-file, or include Form 1098-C as a PDF attachment if your tax software allows. The 1098-C shows the gross proceeds from the sale of the vehicle unless one of the following two exceptions applies.

What happens if I didn't get my 1098-C?

If you not receive Form 1098-C by the filing deadline, you may either request an extension or file the return without claiming the deduction, and amend the return after receiving Form 1098-C.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit forgot to enter 1098 c on turbotax in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your 1098 c tax form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out the electronic filing form 1098 c form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign instructions contributions. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I fill out form 1098 c filing deadline on an Android device?

On an Android device, use the pdfFiller mobile app to finish your instructions 1098 c. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is IRS Instruction 1098-C?

IRS Instruction 1098-C is a form used by organizations to report contributions of motor vehicles, boats, and airplanes that they receive from donors.

Who is required to file IRS Instruction 1098-C?

Charitable organizations that receive qualified vehicle contributions valued at more than $500 are required to file IRS Instruction 1098-C.

How to fill out IRS Instruction 1098-C?

To fill out IRS Instruction 1098-C, organizations must provide information about the vehicle, donor details, and the date of the contribution, as well as its fair market value and any sale information if applicable.

What is the purpose of IRS Instruction 1098-C?

The purpose of IRS Instruction 1098-C is to ensure accurate reporting of non-cash charitable contributions and to provide the IRS with information about donations for tax purposes.

What information must be reported on IRS Instruction 1098-C?

The information that must be reported on IRS Instruction 1098-C includes the donor's name, address, Social Security number (or identification number), the year of the contribution, vehicle details (make, model, VIN), and details regarding the sale or disposition of the vehicle if applicable.

Fill out your IRS Instruction 1098-C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1098c Form is not the form you're looking for?Search for another form here.

Keywords relevant to irs form 1098 c printable

Related to irs 1098 c form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.